texas estate tax rate

The top estate tax rate is 20 percent exemption threshold. For most of the federal estate tax tiers youll pay a base tax.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

We dont make judgments or prescribe specific policies.

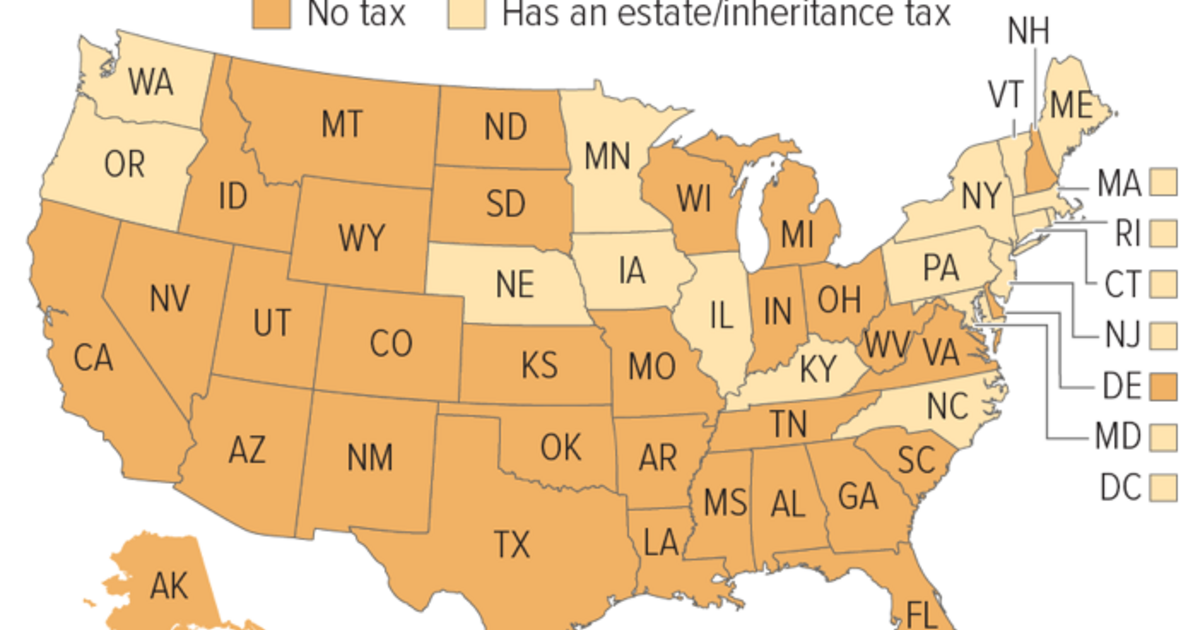

. 2020 rates included for use while preparing your income tax deduction. Property Tax Transparency in Texas. No estate tax or inheritance tax.

Austin TX Sales Tax Rate. We update this information along with the city county and special district rates and levies by August. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Learn about Texas property taxes 4CCCE3C8-C54F-4BB6-AE6D-FF81FD0CDE953x. In 2019 the Texas Legislature passed legislation to help Texans better understand tax rates in their home county. However any estates worth more than that are taxed only on the amount that surpasses the 1206 million threshold.

While Texas doesnt have an estate tax the federal government does. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. The state repealed the inheritance tax beginning on Sept.

Each are due by the tax day of the year following the individuals death. This means that any estates that are valued over 117 million dollars will be taxed before any assets are transferred to the heirs. The latest sales tax rates for cities in Texas TX state.

But in TX this credit is no longer included on the federal estate-tax return. Overview of Texas Taxes. The state sales tax rate in Texas is 625 percent.

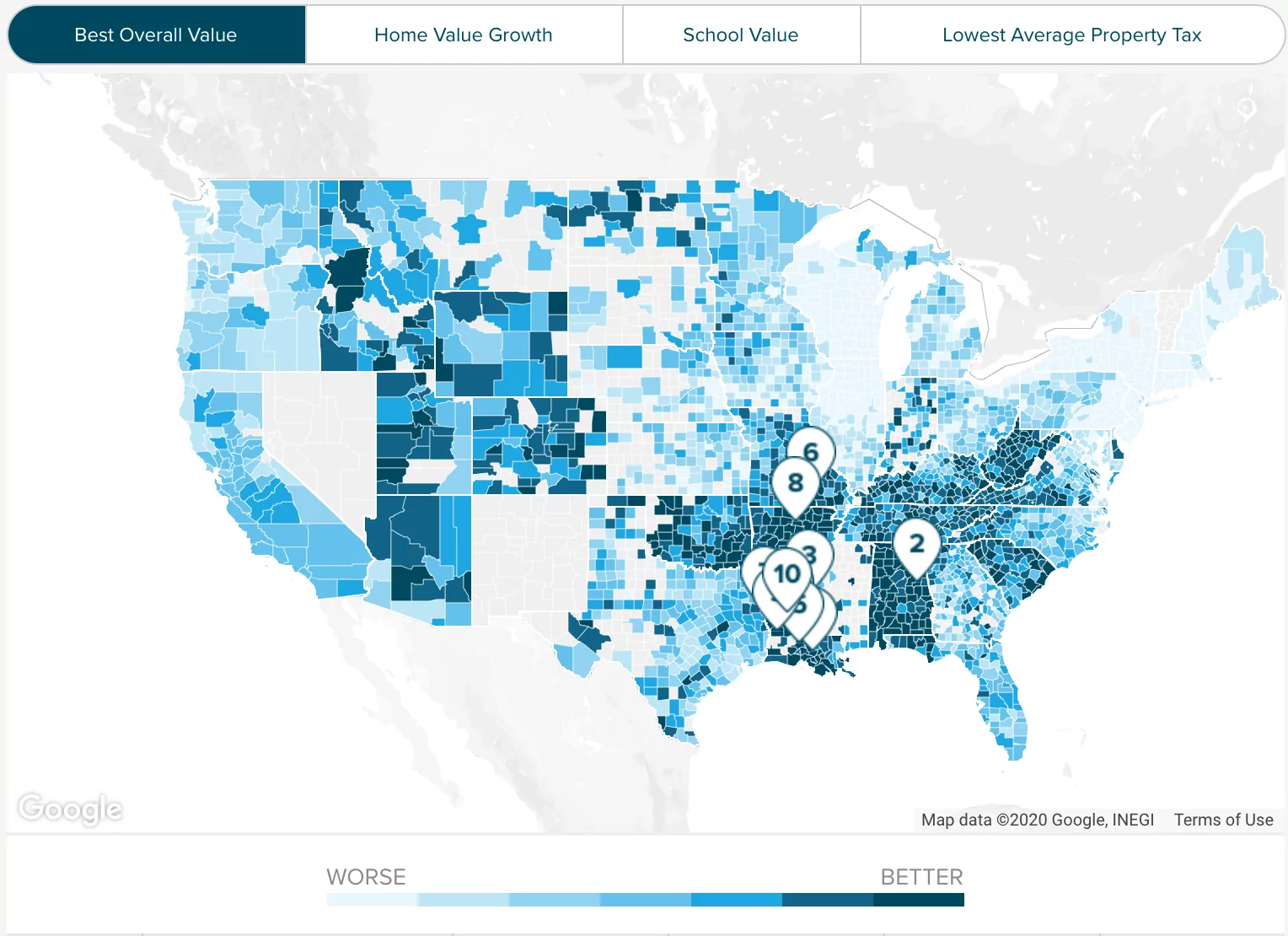

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. The 2022 state personal income tax brackets are updated from the Texas and Tax Foundation data. Arlington TX Sales Tax Rate.

Interactive Tax Map Unlimited Use. No estate tax or inheritance tax. Before the official 2022 Texas income tax rates are released provisional 2022 tax rates are based on Texas 2021 income tax brackets.

Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate. Rates include state county and city taxes. Beaumont TX Sales Tax.

Imagine your family was based in Texas but youre inheriting. Texas has some of the highest property taxes in the US. That said you will likely have to file some taxes on behalf of the deceased including.

This means that the state does not have an inheritance or an. We update this information along with the city county and special district rates and levies by August. Amarillo TX Sales Tax Rate.

School tax rates dropped by 13 since the bills passed in 2019 but taxable property values rose by 23 according to the study. The budgets adopted by taxing units and the tax rates they set to fund those budgets play a significant role in determining the amount of taxes each property owner pays. Anything over these amounts will be taxed at a rate of 40.

Final individual federal and state income tax returns. The average effective property tax rate in the Lone Star State is 169. To make things simple if your estate is worth 1206 million or less you dont need to worry about the federal estate tax.

11 hours agoThe preliminary tax rate for Killeens fiscal year 2023 budget will not exceed 6326 cents per 100 assessed. 10 hours agoFor a home with a tax value of 200000 in 2021 an owner would owe 108020 in property taxes to Hewitt. Cities counties and hospital districts may levy a sales tax specifically to reduce property taxes.

Married couples can shield up to 2412 million together tax-free. The other main thing that you should be careful of is the laws in other states. The Texas estate tax system is a pick-up tax which means that TX picks up the credit for state death taxes on the federal estate tax return.

There are no inheritance or estate taxes in Texas. There have been building permits taken out in Lubbock. Abilene TX Sales Tax Rate.

The top estate tax rate is 16 percent exemption threshold. Federal Estate Tax Rates for 2022. 1 day agoLUBBOCK Texas KCBD - The Lubbock City Council began a series of work sessions Monday to review the proposed budget for the next fiscal year which includes a lower property tax rate that will still generate more than 4 million in new revenue for the growing and more valuable city.

We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the commissioner of education prior to Feb. See what makes us different. No estate tax or inheritance tax.

Texas tax forms are sourced from the Texas income tax forms page and are updated on a yearly basis. 1 The type of taxing unit determines which truth-in-taxation steps apply. Cove council proposes lower property tax rate 2.

As of 2022 if an individual leaves less than 1206 million to their heirs they wont have to worry about paying any federal estate tax in the US. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. Ad Lookup Sales Tax Rates For Free.

No estate tax or inheritance tax. Use the directory below to find your local countys Truth in Taxation website and better understand your property tax rate. We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the commissioner of education prior to Feb.

Assuming an 8 increase to 216000 for 2022 and the citys proposed tax rate the bill.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

States With The Highest And Lowest Property Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Why Are Texas Property Taxes So High Home Tax Solutions

Texas State Taxes Forbes Advisor

Sales And Use Tax Rates Houston Org

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Alameda County Ca Property Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada